Roth Conversions: Choose When To Pay Your Taxes | Josh McAlister

Do you have questions about your family’s specific situation? Set up a time to talk to one of our private wealth advisors, Josh McAlister, CFP®, RMA®, CPA:

As a reminder, there are 3 sources of capital – Human, Financial and Social. For most of us, our financial capital is held within tax deferred retirement accounts – 401ks, 403bs, and IRAs. All well-constructed retirement plans include the optimization of taxes within your financial capital. Households optimize this through a strategy known as a Roth Conversion. Prior to performing a Roth Conversion, there are 4 fundamental questions you need to answer prior to executing:

What are the rules of a tax-delayed account?

What is a Roth Conversion?

How does a Roth Conversion Work?

Why do Roth Conversions Matter?

What are the rules of a tax-delayed account?

Almost all retirement plans (401k, 403b, Traditional IRAs, etc) are what are called “tax deferred retirement plans.” I prefer the term tax-delayed, and will utilize that language throughout the remainder of this article.

In a tax-delayed account, the taxpayer receives the benefit of delaying current taxes due into future years. The current year taxable income is reduced by the amount contributed by the employee to their retirement plan. See the below illustrations as an example, assuming an annual $250,000 income:

No doubt you see the difference between the two scenarios in tax savings year over year, but how and what money is eventually taxed within these delayed accounts?

How is it Taxed: Money is taxed upon withdrawing the funds from the delayed account at your marginal tax rate upon distribution.

What is Taxed: All pre-tax contributions, both from the employee and the employer, and any investment growth is taxed upon distribution.

The next question you should be asking is: How do I optimize the taxes I will eventually owe?

Enter: Roth Conversion

What is a Roth Conversion?

This strategy converts your tax-delayed financial capital money into a Roth IRA, which grows tax free. Roth IRAs are incredible, the owner of the account never pays taxes on any of the funds, including contributions, conversions, and future investment growth.

By converting tax delayed money to a tax-free Roth IRA account, income taxes due must be paid on the converted funds in the year of conversion.

Roth conversions have incredible flexibility. An individual can convert any dollar amount each year with no limit on the number of conversions to be executed in any year. I like to describe Roth Conversions as simply net worth and tax bracket management – reduce the tax payment to be made in future years in the current year. The best benefit – you control the timing of when you pay your tax liability that will be inevitably due.

Note that all Roth Conversions must take place before the end of the taxpayer’s calendar year – most likely, 12/31.

How does a Roth Conversion Work?

For the purposes of our Roth Conversion illustration, let us assume a taxpayer will be in the 24% tax bracket when funds are pulled out of the tax delayed accounts at retirement. Throughout the course of their life, it is natural that the taxpayer’s income levels will change, which is common for athletes, business owners, and high net worth individuals.

Many individuals would say they are worth $1.5M prior to the funds being taken out of the traditional IRA. They are forgetting the embedded tax liability within the IRA, and assuming a 24% tax bracket, their net worth is reduced to $1.32M - $180,000 will go to Uncle Sam. Note the taxable brokerage account is not tax delayed – the $180,000 tax liability is only applicable to the IRA.

Revisiting: “I like to describe Roth Conversions as simply net worth and tax bracket management over multiple years.”

If we can effectively reduce the tax bracket of the embedded tax liability within the IRA – we can increase net worth of the household substantially. See below for example:

Notice the increase in net worth from $1.32M to $1.41M by simply converting as many dollars as possible from the IRA to a Roth IRA throughout the taxpayer’s life.

Why do Roth Conversions Matter?

Impact of Tax-Free Growth:

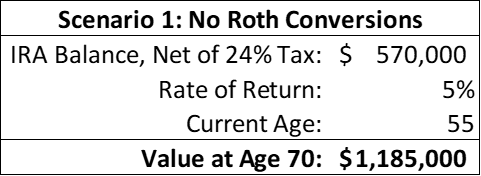

I really cannot think of anyone who would not benefit from a tax-exempt account. Let us compare real dollars, net of tax for the above $750,000 IRA balance. The first scenario shows no conversions, and taxes are paid at the 24% tax bracket through age 70, and the second show the impact of the conversions, paid at the 12% tax bracket being completed by age 55:

That is a $187,000 compounded annual growth over 15 years – incremental steps are powerful over the long haul.

Free Resource:

Conclusion:

Tax liabilities within tax-delayed accounts are commonly overlooked – and thus real dollars are lost. Roth conversions need to be executed over many years in order to effectively manage the taxes paid. Often, households start to bring attention to this when entering into retirement, which can be too late.

Partner with an advisor who advises on your entire net worth in after tax dollars, not just your investments.