Sources of Capital: Redefining Retirement | Josh McAlister

I cannot stress this enough – retirement is within your control through the construction and then execution of a well thought out retirement plan. We must start with the foundation for what we are trying to solve:

Retirement: The process of executing your pre-defined financial independence.

What is financial independence?

Financial Independence: Placing no reliance on a job or anyone else to maintain your chosen lifestyle.

This is the first of a 12-part series where we hope to provide clarity and confidence to your retirement plan structure. Like constructing a home, it would be foolish if we did not start with anything else other than the concrete slab.

Your sources of capital are the concrete slab in determining your retirement calculation. Calculation? Yes we can, and you should demand a calculation that identifies what your number is to fund your retirement lifestyle. This article aims to give you the tools to accomplish just that.

Sources of Capital:

As a reminder, below are the three sources of capital:

(1) Financial Capital – Money earned from investments:

401(k)

403(b)

IRA

Roth IRA

Taxable Brokerage Accounts

Checking/Savings

Rental Real Estate - note the illiquidity of the hard asset of real estate poses an issue to navigate in any retirement plan.

(2) Social Capital – Money accumulated from the work of yourself and others:

Social Security

Pensions

Potential Inheritances

(3) Human Capital – Money earned from vocation. This is future money to be earned.

Employment

Business Ownership

The Calculation:

Retirement planning is a puzzle – lifestyle spending needs to be funded from either social capital (social security), human capital (work) or financial capital (savings). First, we must plan the following:

What do you want to spend annually in retirement?

This is easy to determine a rough number, and with some helpful software, we can refine the number to what you spend on an annual basis. We call this spending your Lifestyle Number.

But what about vehicle purchases? On average Americans change vehicles every 7 years. Home purchases? We stay in homes for 7-10 years.

You might be saying, “well I’m content with my vehicle, and I’m not leaving my home forever.” That is great – but what about things outside your control? Medical expenses? Inflation? These are not as tricky to plan for as they sound, but they are commonly missed.

All these items, cars, homes, medical expenses, vacations, etc. – we call those Priorities. Priorities can be annual recurring, every other year, or even just a one-time event. Clear distinction of these – they are not included within your normal everyday cash out flow.

In the last article, we mentioned the importance of an income statement that determines their 4 Uses of Money. If, on an annual basis, you know what your 4 Uses of Money are, you can bring greater clarity and confidence into your retirement plan by adjusting your investments accordingly to match your priorities.

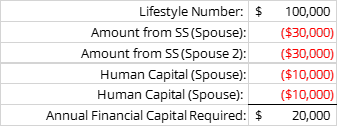

For example – let’s say you are age 60 contemplating retiring at age 67, and you desire to know if you will have enough saved. Your Lifestyle Number is $100,000 - and as a reminder, this is the cost to fund your life - which includes mortgage, property taxes, insurance, food, shopping, gas, utilities, etc.

Both you and your spouse in retirement will receive $30,000 each of social security benefits (social capital) and you both plan to work at something that you desire to work part time at (human capital) and earn $10,000 each. (I like to give the example, ‘if you like tools, you can go work with tools at Home Depot’). The question then becomes – to maintain this lifestyle – what do I need annually from my financial capital? The answer is not $100,000 – it is $20,000.

$20,000 represents your essential spending throughout retirement – spending that you do not want to take unnecessary investment risk with as you move through retirement. Think of this as your protective reserve to build the best chance for not outliving your money. To give the reader a frame of reference – to protect $20,000 annually for 30 years through retirement in a fixed income matched duration portfolio – you would need an estimated $671,000 dollars saved today. By accomplishing this – you have built your retirement savings floor.

From there – an advisor should then learn what priorities are specific to your situation to plan for with your dollars. After planning for your priorities, the rest of your investments should then be exposed to upside, which we will cover in a later blog titled: “Retirement Investing.”

Free Resource:

Conclusion:

The foundation of retirement planning starts with knowing what you want to spend throughout retirement, and then determining your sources of capital to optimize your dollars.

Next week – we will dive deeper into Social Capital, where we will give you tips and tricks on how to optimize your social security.