401(k): Savings and To Tax Delay or Not Tax Delay? | Josh McAlister

Many of us have had to fill out a form or input a certain amount of money to be deposited into our 401(k) account. Usually, we determine this savings amount during an onboarding process of a new job or career. Sadly – this is often the last time we look at our 401k contributions.

My goal is to help you understand two vastly important items regarding your 401(k) contributions in this article:

Savings Rate > Investment Return Rate

Should you consider Traditional (pre-tax) or Roth (post-tax) contributions

Why Your Savings Rate Matters More Than Your Investment Return Rate:

Have you ever been to a holiday party or a social gathering and experienced someone talking very loudly about their investments? And, if they are speaking loudly about them, they were likely talking about their winners, correct?

I am here to tell you that their loud voice likely masks their insecurities surrounding their finances. Most likely, their lack of understanding of their own cash flow, uncertainty of income, and misunderstanding of what it will take to fund their lifestyle through retirement is what is driving their facade. Best part is – their language surrounding an investment that is up X to x percent is likely not going to be the driver of their wealth long term.

Morgan Housel in his book “The Psychology of Money” documents this notion clearly.

“The First Idea – simple, but easy to overlook – is that building wealth has little to do with your income or investment returns, and lots to do with your savings rate.”

Investment returns can no doubt net you money and grow your wealth if done appropriately. But whether an investment strategy will work, how long it will work for, and whether your life priorities stay the same are always in doubt. Uncertainty rules our financial lives, and any investment manager who says they can remove absolute uncertainty should be avoided at all costs.

Personal savings and living below your means – these are the parts of the money equation that is entirely within your control. If you live on less than you make every year for the rest of your life, you are guaranteeing you will have absolute financial success. You make that guarantee for yourself!

For example, let us say that Bobby and Durby have the same net worth. Bobby and Durby have 2 different approaches to finances – Bobby is the better investor, but Durby is the better saver of money. Bobby earns 12% on his investments, Durby earns 8%. Durby however only needs half of what Bobby needs to fund his lifestyle. How does these facts impact the both of them?

Durby has more money in the long run as his savings compound on themselves, while Bobby’s lifestyle costs compound against him. Savings Rate is thus greater than your investment return rate.

Pre-Tax or Post-Tax 401(k) Contributions?:

Let me reiterate the above section – if you are saving into a retirement vehicle, any vehicle, you are ahead of most. Why? Because you are saving – something 78% Americans do not do. FYI – the Forbes article linked was written pre-COVID pandemic. Yikes.

So, for the 22% of savers out there, the natural question is how to optimize your savings? The answer: understanding how your savings will be taxed. Let’s take a quick look at the differences in contributions:

Traditional:

Pre-tax 401(k) contributions, traditional IRA contributions, SEP IRA contributions, and pre-tax 403(b) contributions are all made tax deferred. I prefer the term tax delayed, as I wrote in a previous article.

Benefit: You receive a reduction to your taxable income in the year contributed.

Downside: Your contributions and investment growth will be taxed upon withdrawal.

Roth:

Roth 401(k) contributions and Roth IRA contributions are all made after tax. Spoiler alert – I like these accounts. Here is why:

Benefit: Your contributions and investment growth will grow tax free (NO MORE TAXES).

Downside: No reduction in taxable income in year of contribution. (WOOP-DEE-DOO).

Traditional line of thinking says that if you are going to be in a higher tax bracket in the future upon withdrawals, you should make a Roth contribution. The opposite line of thinking holds true.

However, this would assume you are able to predict your future income, life catastrophes, life priorities, and future financial successes and failures. I am about as good at predicting my own income as I am predicting the weather. Let’s take a look at what the math says holding constant variables between the two scenarios:

The Math:

Traditional 401(k):

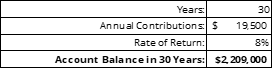

Say you contribute the maximum amount an employee can contribute ($19,500) annually into a traditional 401(k) account for the next 30 years and it grows at an 8% average return rate. At the end of thirty years, this account has grown to approximately $2,209,000. However, this is not the full picture!

You do not have $2,209,000 at your disposal – you must consider taxes. In traditional 401(k) accounts, Uncle Sam is either getting their money now, or later. We have already discussed how difficult it is to project income, and thus tax rates, so let us assume this individual has a 40% effective tax rate throughout their life. Taxes reduce their account balance by $883,600! In addition to the obvious tax bill of almost $900K, this decrease has a dramatic effect on the future compounding returns of that account. Oh Boy.

Roth:

When calculating the future value of a Roth including taxes, we start with the same variables and account balance of $2,209,000.

This again does not show the full picture. We must reduce our account balance by the tax benefit we did NOT receive in the year we made every $19,500 contribution. See below:

EVEN AT THE HIGHEST TAX BRACKET – the tax-free growth wins. It wins by about $649,600 between the two approaches. Safe to say, we are fans of the Roth.

Conclusion:

Savings rate matters more than your investment return rate, bottom line. The numbers we compared above in a traditional 401(k) vs. a Roth 401(k) are exciting and fun, but none of that happens without the annual $19,500 contributions. Plan for that first before you start discussing what investments you are in, and what the tax benefits are to you and your family.