Negotiating Your Signing Bonus Payment Structure

Are you familiar with how a signing bonus is paid out? Historically, teams have split the gross amount into two equal payments over two years.

It is a common misperception that the 50/50 payment structure is the only option. Not only is this false, for the majority of players it is also the least advantageous.

As a player, your ultimate goal is not the gross signing bonus amount; rather, it is the net (after-tax) amount. How your signing bonus payout is structured will have the greatest impact on how much money you actually receive.

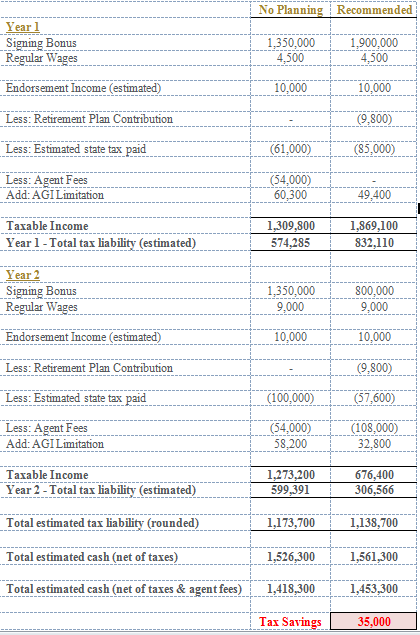

Which option would you choose if you signed for $2,700,000?

Option 1: $2,700,0000 paid in year 1

Option 2: $1,350,0000 paid in year 1 & $1,350,000 paid in year 2

Option 3: $1,900,000 paid in Year 1 & $800,000 paid in year 2

Option 1: The Bonus Is Paid In One Lump Sum – The Worst Option!

This is a huge mistake to always accelerate the total amount into the first year. This option neglects the opportunity to take advantage of the graduated tax rates in year two. Ultimately, creating the largest tax liability of all three options.

Option 2 versus Option 3

From this analysis it is clear that option 3 is the best option with a net-tax savings of $35,000.

Prior to being drafted, analysis should be prepared in order to determine the true value of a potential signing bonus after-tax.

Professional athlete taxes vary greatly depending on a number of factors including the language of your contract, the timing of payment, your itemized deductions and residency. All of these factors come into play when determining how signing bonuses are taxed and no two cases are the same.

Accelerating or deferring the bonus into uneven payments can generally reduce the overall liability, depending on the circumstances.

It’s not what you sign for that matters but what you put in your pocket.

Many families ask, “doesn’t my agent do this?”

The best agents recognize the importance of tax planning and will request the support of a Certified Public Accountant (CPA) who specializes in working with professional athletes. However, agents are equally cautious to keep themselves separate from a player’s financial decisions to avoid any potential conflicts of interest. This puts the responsibility on the player and his family to ensure the tax planning is happening.

Signs That You May Need a Second Opinion

Your agent is telling you not to worry about a financial advisor until after the draft

Your agent tells you a team will never negotiate the structure of your bonus

Your agent tells you a 60/40 split is how you should structure it

In 2016 we have worked with 5 1st Round draft picks and their agents to negotiate the most tax efficient payment structure. It is important to realize that this is one of many factors in the negotiation so there is no guarantee that a team will agree to your ideal structure. However, at a minimum a projection similar to the one above should be presented to you by your agent and CPA® showing that the analysis has been done.

I would highly encourage you to ask for an example of a contract from a player they represented in last year’s draft similar to the one below. This will give you the confidence that your team has the expertise necessary.